Physical Address

Pune, India

Physical Address

Pune, India

Hello traders! Welcome to this week’s analysis of Order Flow & Market Profile in the Indian stock market. If you want to get a clear picture of how big players are influencing the market and how key price levels are forming, you’re in the right place.

This blog will help you understand the key market dynamics, absorption levels, and potential trade opportunities in the last week of March. Let’s dive in!

This week, Nifty index saw a mix of directional and sideways move as the big players adjusted their positions ahead of the financial year-end. The market initially opened with a slight gap-up but faced resistance near key level of 23800, leading to a pullback mid-week.

The Nifty futures continuous contract approximately moved 450 points between 23450 to almost 23900. As from the volume profile chart for Nifty futures we can see, 23600 was the most traded price level, showing strong institutional interest. And high activity range of the price can be seen between value area high (VAH) 23750 and value area low (VAL) 23550. Nifty futures bounce from 23450 level along with a rising volume point of control (VPOC) shows that buyers are stepping in. If price sustains above VAH, we might see an upward move toward 23900 and a closing below VAL may indicate a downward pressure.

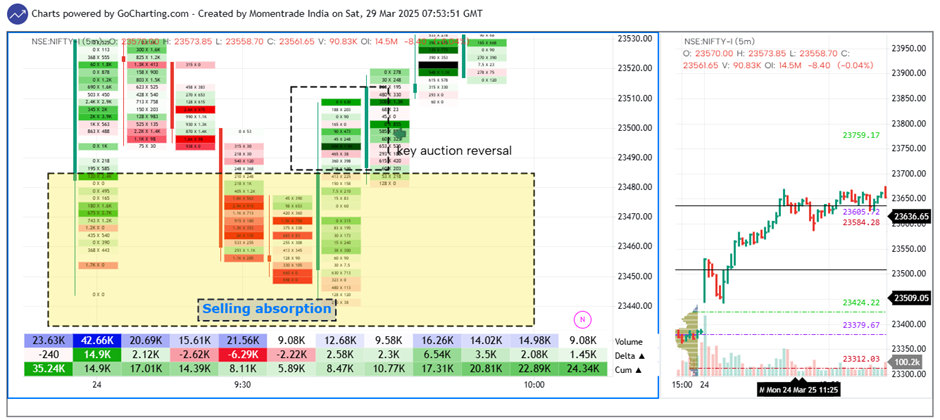

On 24th March, the reversal setup could be traded using the footprint chart. The selling pressure got absorbed at the key price level of 23450. This was followed by the trend reversal setup as explained in our YouTube tutorial video. As we can see from the chart, single time framing resulted in capturing decent 120 points in this trade.

Banking Sector

This week, Bank Nifty mirrored some of Nifty’s movements but showed relatively higher volatility. Unlike Nifty, which managed a steady recovery, Bank Nifty faced selling pressure at higher levels, leading to choppy price action. The financial sector saw mixed sentiment, with PSU banks underperforming while private banks provided some support.

Trade Opportunities

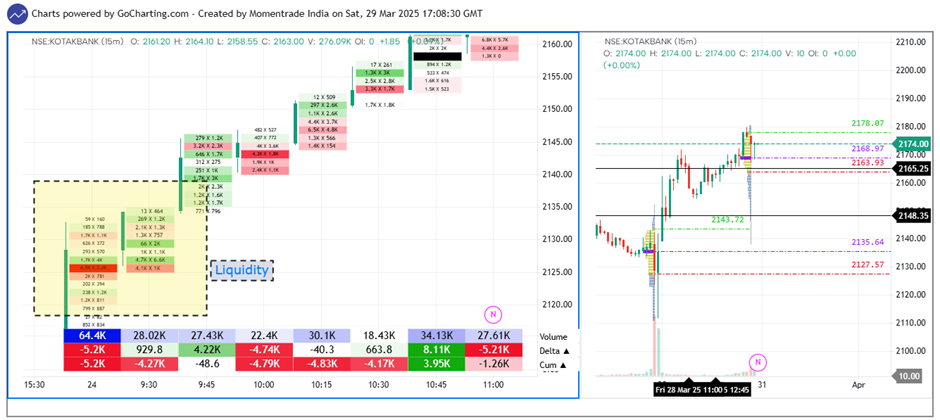

Among the major trade opportunities, Kotak Mahindra Bank on 24th March wins the race. We can see that, significant sell-side liquidity was seen around 1225 price level, with a strong follow-through buying. This gave a decent 1:2 trade.

Next in line is SBI Bank. The same liquidity concept could be applied to capture the trend in this stock on 24th March.

Apart from these two, other trading opportunities were observed in the following Banking stocks:

HDFC Bank: Aggressive buying at 1808 price level was defended on 25th March at 9:15 am.

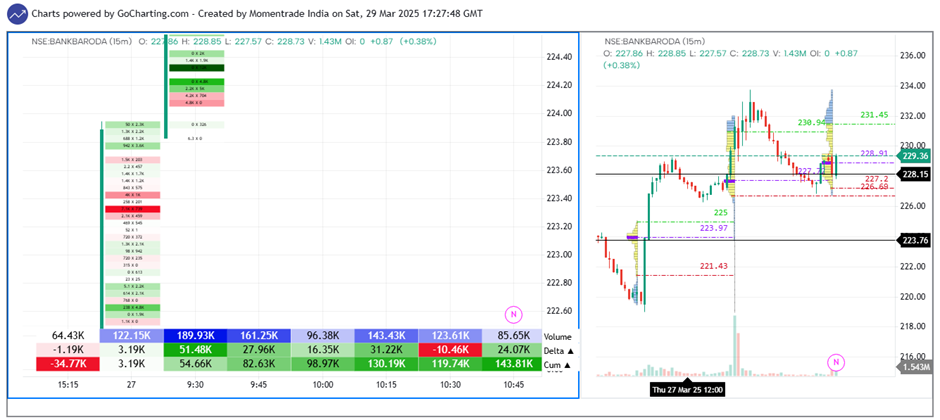

Bank of Baroda: Sell-side liquidity was provided at 223 price level, however, an aggressive entry was required to capture this trade on 27th March.

IT sector

This week, Nifty IT showed higher volatility as compared to Nifty 50 index. Both indices experienced declines over the week, with the Nifty IT index showing a slightly larger percentage decrease comparatively.

Trade opportunities

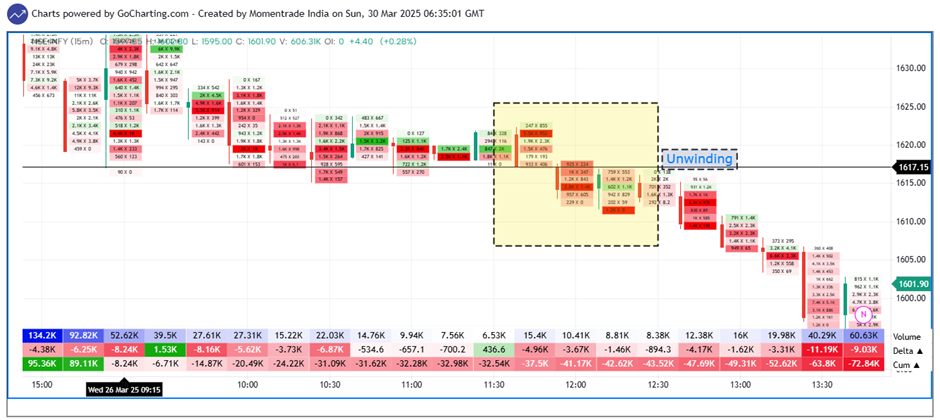

Under IT sector, a few stocks gave a very good unwinding trade opportunity. Among these, Infosys on 26th March at 11:45 am can be considered as a clean unwinding setup to enter. This trade also resulted into decent 1:2.

Other potential trade opportunities in IT sector were observed in the following stocks:

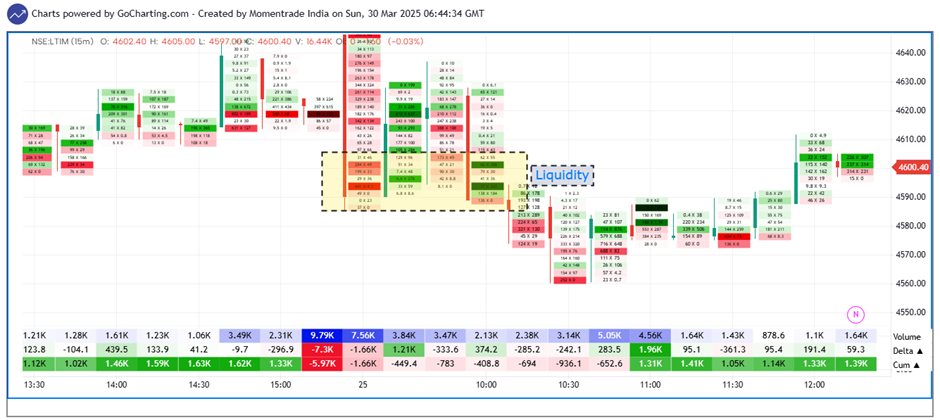

LTIM: On 25th March at 10:00 am, the buy-side liquidity was absorbed by decent further selling, giving a decent 1:1 trade.

HCLTECH: 28th March was a double distribution day for this stock as per volume profile. This scenario could be traded as shown in your Youtube tutorial video on double distribution day.

FMCG sector

Over the past week, ending March 28, 2025, the Nifty FMCG index gained 1.2%, showing steady but cautious growth. Meanwhile, the Nifty 50 index climbed 1.5%, outpacing the FMCG sector by 0.3 percentage points. This suggests that while FMCG stocks held their ground, they lagged slightly behind the broader market’s momentum.

Trade opportunities

The major trade opportunities in FMCG sector could be grabbed in Godrej Consumer Product and ITC.

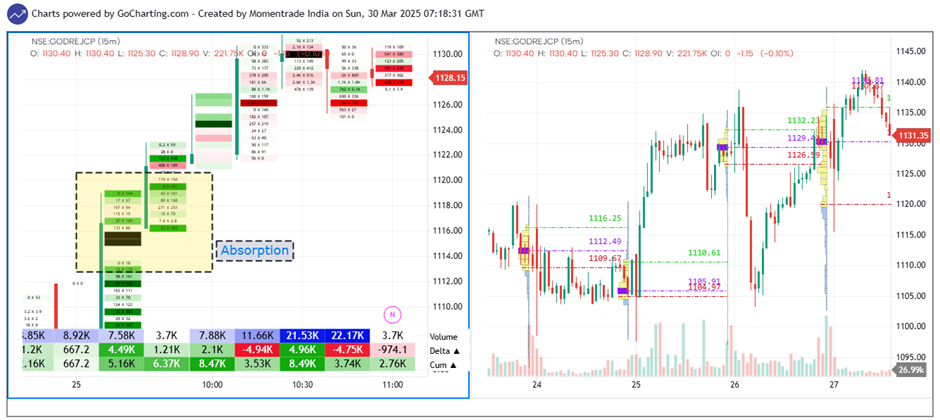

GODREJCP: On 25th March at 9:15 am, selling pressure was absorbed by the buyers at 1115 price level. And sharp up move was observed after that. A decent 1:2 could be captured here.

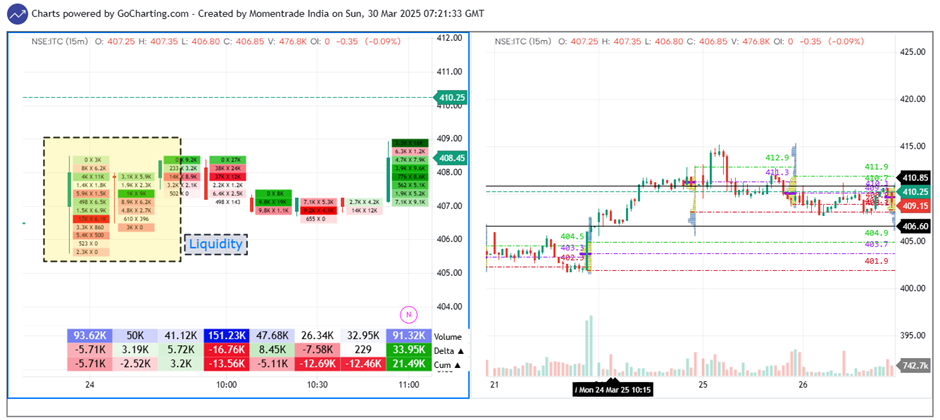

ITC: On 24th March, 9:15 am liquidity was provided between 406 and 407 level. This lead to consolidation and subsequent up move in this stock. This trade resulted into fair 1:1 profit.

Pharma sector

During the week ending March 28, 2025, the Nifty 50 index recorded a minor drop of 0.17%. In contrast, the Nifty Pharma index declined by 0.9% on the same day, influenced by investor concerns over potential U.S. reciprocal tariffs. This suggests that the pharmaceutical sector lagged behind the broader market over the week.

Trade opportunities

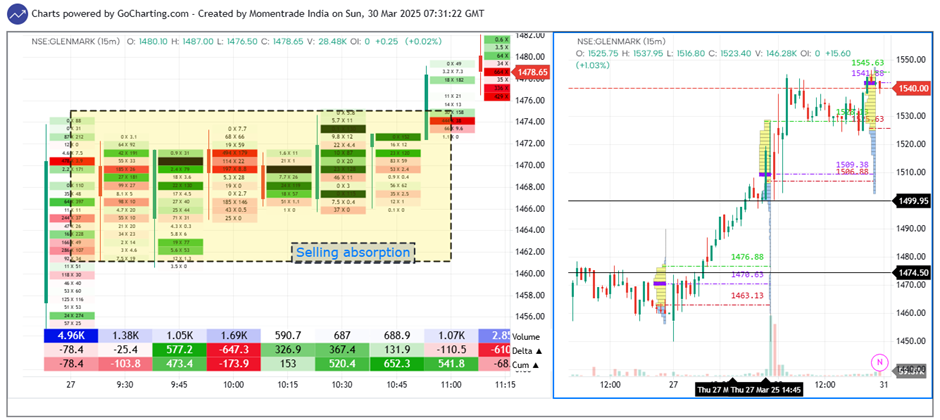

GLENMARK: The selling absorption was seen between 1460 to 1470 price level. And price further trended upwards on 27th March. This stock could be traded with reversal strategy as well since the previous 3 days this stock had moved down and reversed on 27th March.

This was the short summary and major trade opportunities observed using Orderflow analysis in the past week. To know more about Overflow, Volume profile, and Market profile you can visit our free resources on this website as well as our YouTube channel “Momentrade”. For advanced learning you can visit our app for paid courses. I hope this blog was a value addition to your knowledge. Feel free to leave a comment to let me know about your opinions.

Interested in learning more and improving your trading skills? Join our training program today to get access to expert market analysis, strategies, and insights tailored to help you succeed in the markets! Reach out to us for more details on how to enroll.

Thank you !

Disclaimer: This is post-market analysis provided here is specifically for individuals who have joined the training program and is intended for educational purposes only. These analyses, which are conducted after market hours, represent my personal opinions and are not a substitute for professional financial advice. I am not a SEBI-registered analyst, and the information shared should not be construed as financial advice, recommendations, or a buy/sell call in any form. The purpose is to help participants review and cross-check their trade opportunities based on real market scenarios. Trading in financial markets involves significant risk, and individuals should make their own decisions based on their risk tolerance and financial goals. Always consult a qualified financial advisor before making any investment decisions.