Physical Address

Pune, India

Physical Address

Pune, India

Hello traders! Welcome to the weekly Indian stock market analysis using Order Flow. As we all know, this week Indian market witnessed intense selling pressure. It was a classic case of nervous markets, influenced by mixed global cues and domestic caution ahead of the upcoming earnings season. In this blog we shall look at what OFA had suggested about this initiative selling and weak buying response.

But before we jump into the real discussion, a gentle reminder to all our enthusiastic learners. We understand that getting a knack of OFA concepts and jargons can be challenging. That is why we constantly keep posting learning resources on our website and YouTube channel. So if you are curious to learn more about what actually works in the market, check it out! Now, resuming our discussion on weekly analysis….

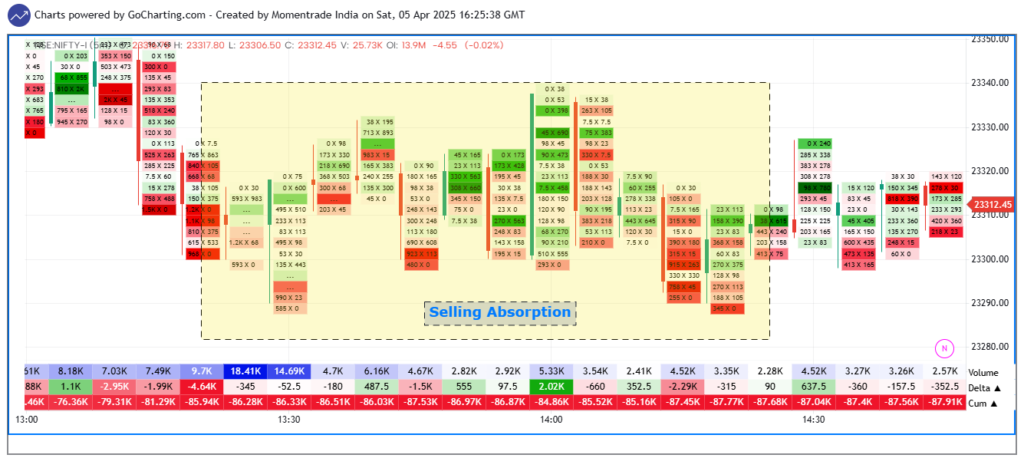

From the very start of this week, buyers didn’t seem to enter the market very actively. Look at the Nifty futures footprint chart for Tuesday, we notice that sellers aggressively entered the market as the day started. It was only in the second half of this session (Fig 1), we could see market selling pressure was absorbed by limit buyers between 23350 to 23300 levels.

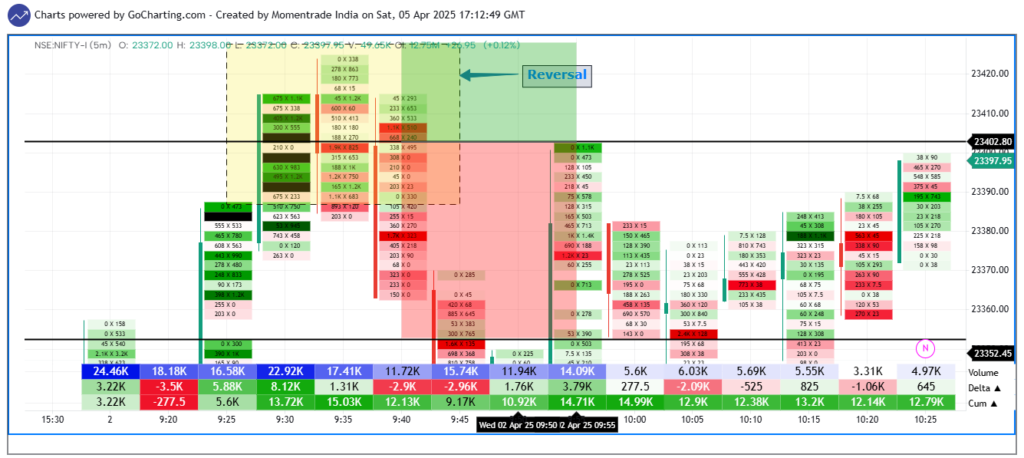

On Wednesday and Thursday, Nifty index tried to consolidate and recover. But due to lack of strength from buyer’s side it turned out to be a failed auction. This was followed by aggressive stepping in of sellers on Friday, dragging the index down to 22,818 before settling just under 22,950 by the close.

Major trade opportunities using OFA

Following the downward directional conviction, there were many good trade setups in the past week in Nifty futures. Amongst those many, the selling initiative setup on Tuesday at 10:00 am was the cleanest setup with the best risk – reward.

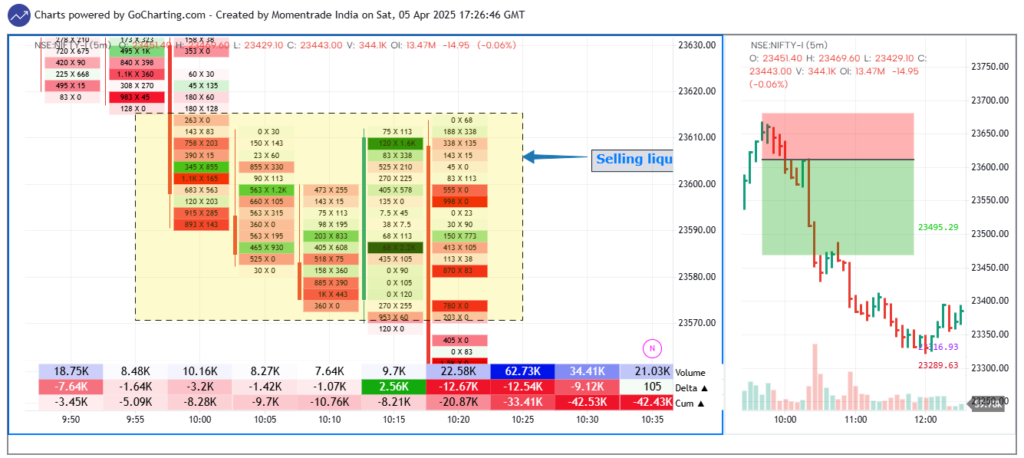

From the above chart, we can see that, liquidity was provided by sellers at the crucial level of 23600. This liquidity was absorbed by the responsive buyers and paved way for further follow-up selling continuation. This trade grabbed a whopping 150 points in Nifty futures by single time-framing.

The next best setup was the reversal trade entry on Wednesday at 9:40 am candle. The scenario played out just as explained in previous blogs as well as in our YouTube video on how to capture reversals. However, given the high volatility in the market, this trade got exited early. So, single time-framing captured a decent 50 points on the Nifty futures chart.

Major Sectoral Trends

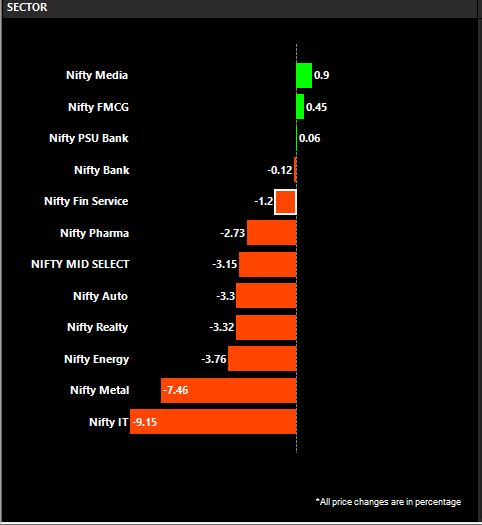

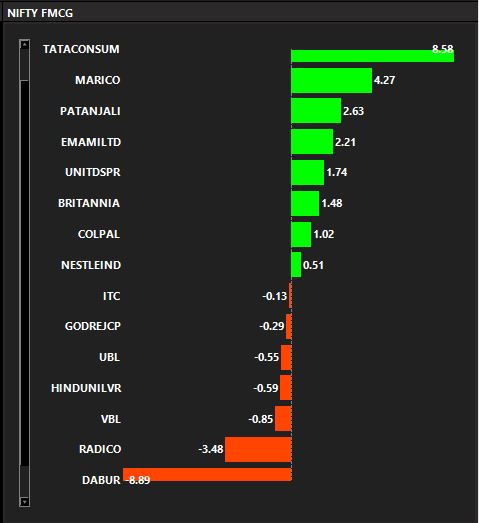

The best performing sector for this week was the Media sector followed by FMCG and PSU banks. Other than these, all sectors came under heavy selling pressure with the hardest blow on the IT and Metal sector.

In order to not make your learning experience boring, we will limit our discussion to the best and the worst performing sectors in the last week.

FMCG Sector

While the broader Nifty 50 index went through a volatile phase and ended the week in the red, the FMCG sector stood out with relatively stable and resilient performance. So, FMCG sector again proved to be the safe spot when the broader market is crumbling. The best performing stock were Tata consumers and Marico, while Dabur showed poorest performance in the last week.

Trade Opportunities

In the banking sector, all types of trading setups were formed using OFA. But here we shall not discuss the advanced setups and stick to basic setups for better understanding. If you are interested to learn more about advanced setups you can check out our website.

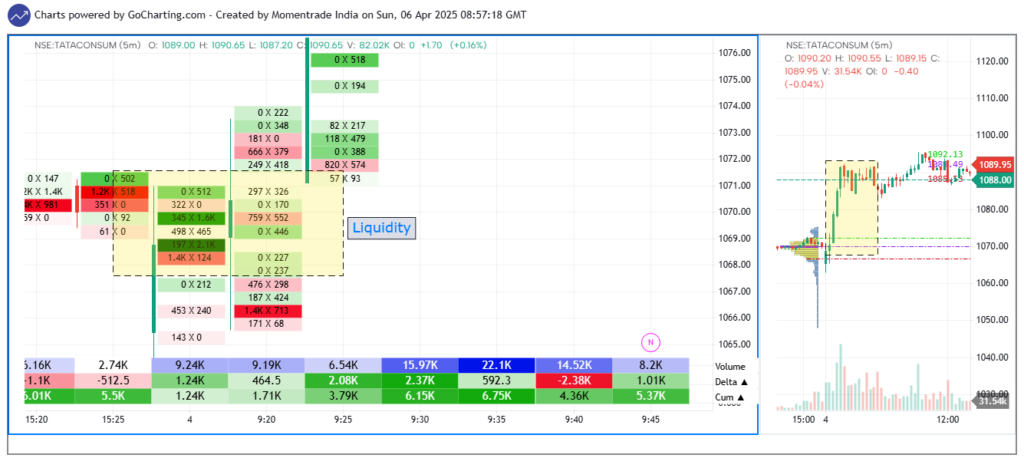

TATA CONSUMER: On 4th April, the trading session started with a buying initiative in TATACONSUM. We can see that sell side liquidity was provided near the 1070 price levels. This liquidity was absorbed by the buyers and the continuation of upward move was seen.

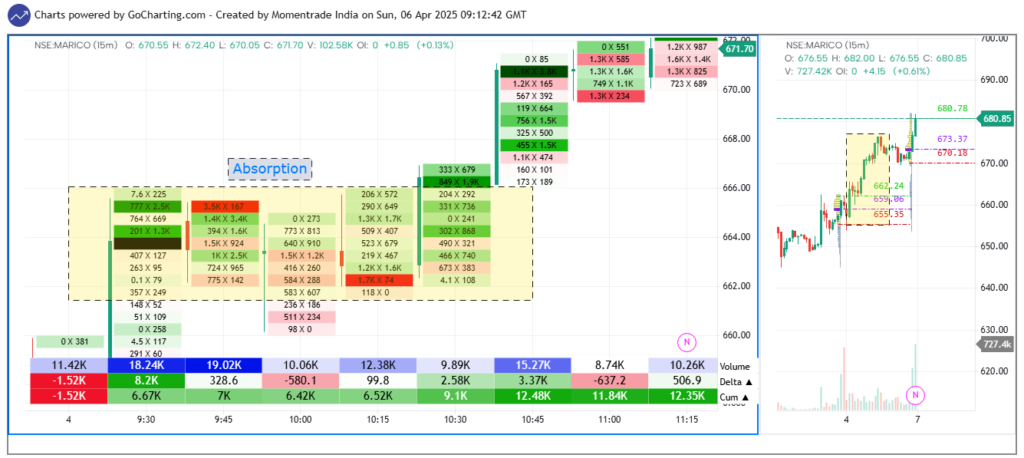

MARICO: From the chart we can see, the aggressive buying in 9:30 am candle was defended by the buyers in the 10:30 am candle. This lead to further upward rally in Marico on 4th April.

IT Sector

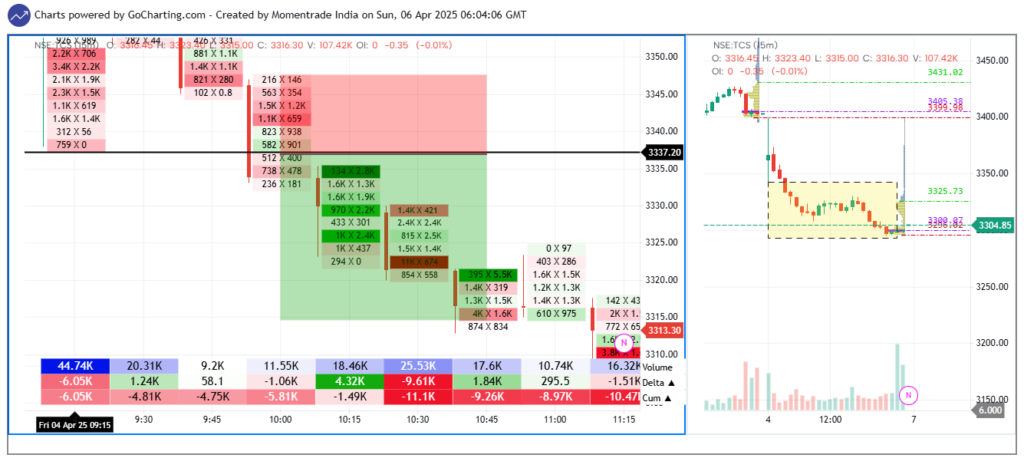

Among all the sectors, IT sector was the worst hit in the past week due to FII outflows, global tech weakness, and rising concerns over US macro data weighed heavily on sentiment. The heavyweight stocks in IT sector such as TCS and Infosys were majorly responsible for dragging lower the Nifty index lower.

Trade Opportunities

Due to high selling pressure and volatility, most of the IT stocks did not show good setups on Order Flow. But a few of them showed a clear unwinding setup, so let’s discuss them:

TCS: On 4th April, TCS gapped down and then buyers tried to enter. But this attempt failed to sustain and we could see a good unwinding at the day low level. This trade gave a decent 1:2 risk – reward.

HCLTECH: Similar unwinding setup was observed in HCLTECH on 1st April at 10:15 am. Please have a look at the chart.

This was the short summary and major trade opportunities observed using Orderflow analysis in the past week.

Interested in learning more and improving your trading skills? Join our training program today to get access to expert market analysis, strategies, and insights tailored to help you succeed in the markets! Reach out to us for more details on how to enroll.

Thank you !

Disclaimer: This is post-market analysis provided here is specifically for individuals who have joined the training program and is intended for educational purposes only. These analyses, which are conducted after market hours, represent my personal opinions and are not a substitute for professional financial advice. I am not a SEBI-registered analyst, and the information shared should not be construed as financial advice, recommendations, or a buy/sell call in any form. The purpose is to help participants review and cross-check their trade opportunities based on real market scenarios. Trading in financial markets involves significant risk, and individuals should make their own decisions based on their risk tolerance and financial goals. Always consult a qualified financial advisor before making any investment decisions.